We deliver incremental insight through sector focused analytics that are central to our client’s deal thesis

use cases

Sector: Industrial Products & Services

Buy Side Diligence & Value Capture

Sector: Healthcare

Value Capture

Cross-sell Optimization

Sector: Industrial Products & Services

Type of Work: Buy Side Diligence & Value Capture

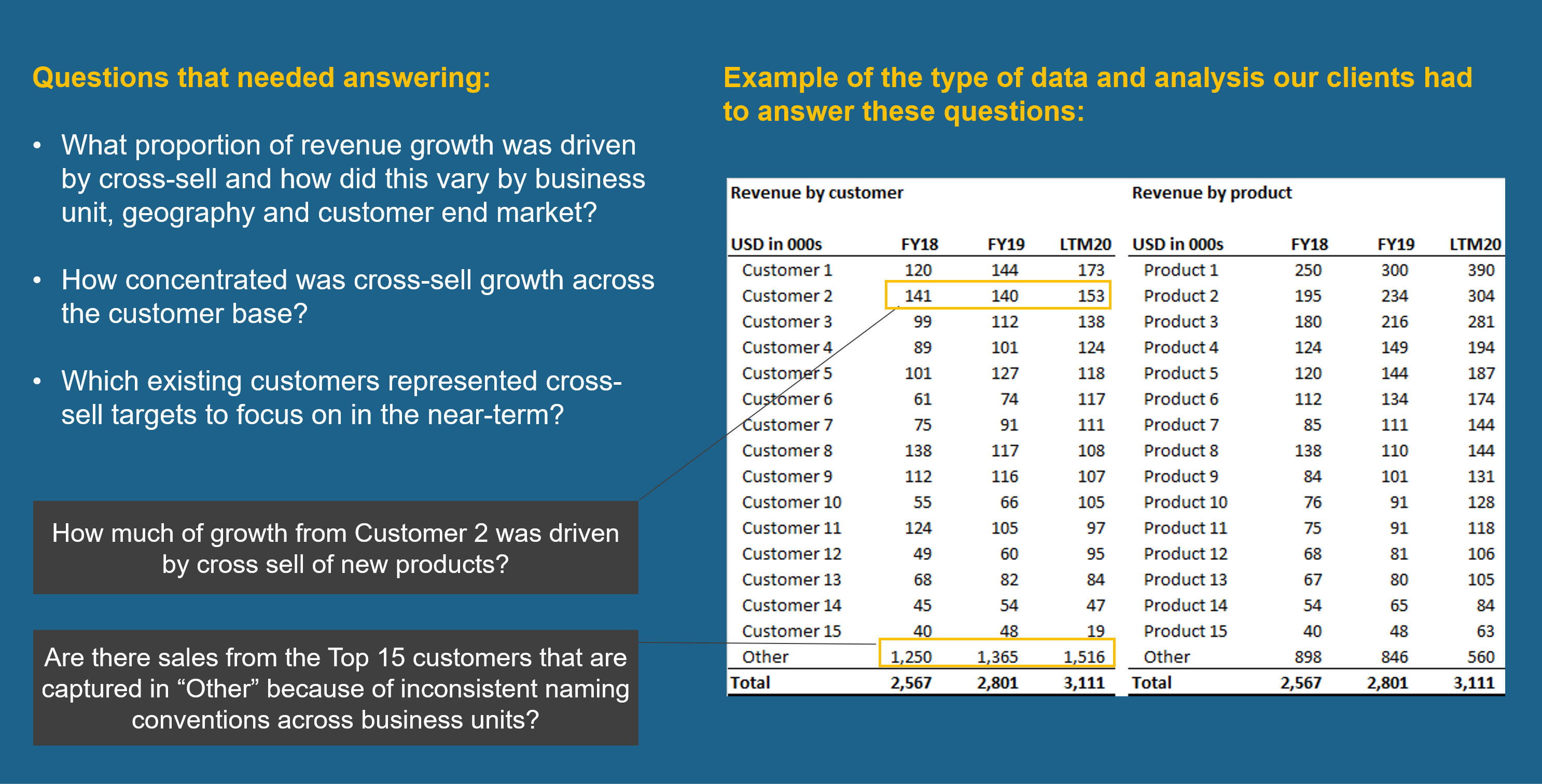

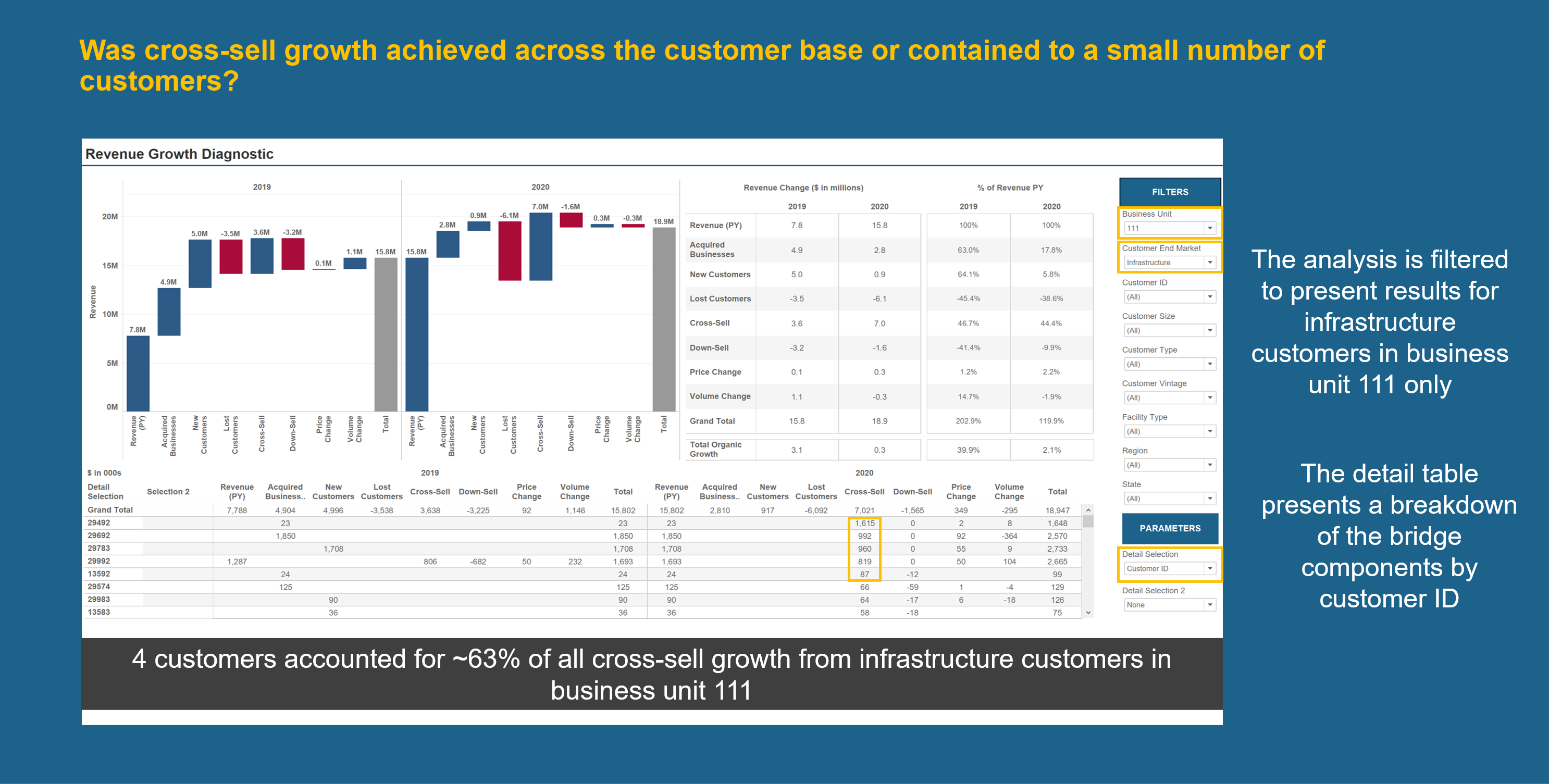

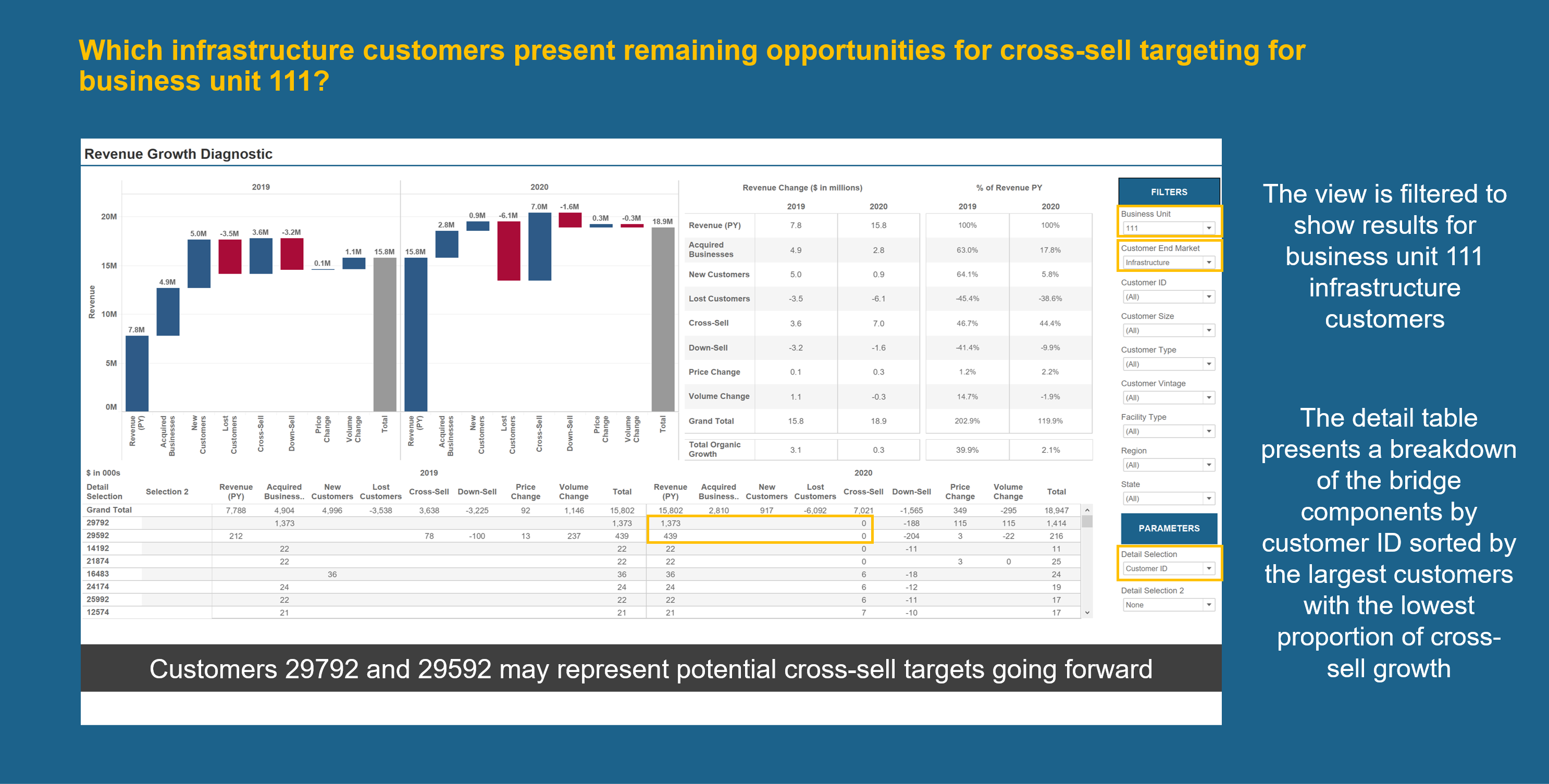

A logistics business was exploring opportunities to drive revenue and earnings growth through cross-sell opportunities arising from recently acquired businesses with new service offerings.

Management were limited in their ability to draw insight around cross-sell performance and identify potential customers to target due to inconsistencies between various data sources across the organization.

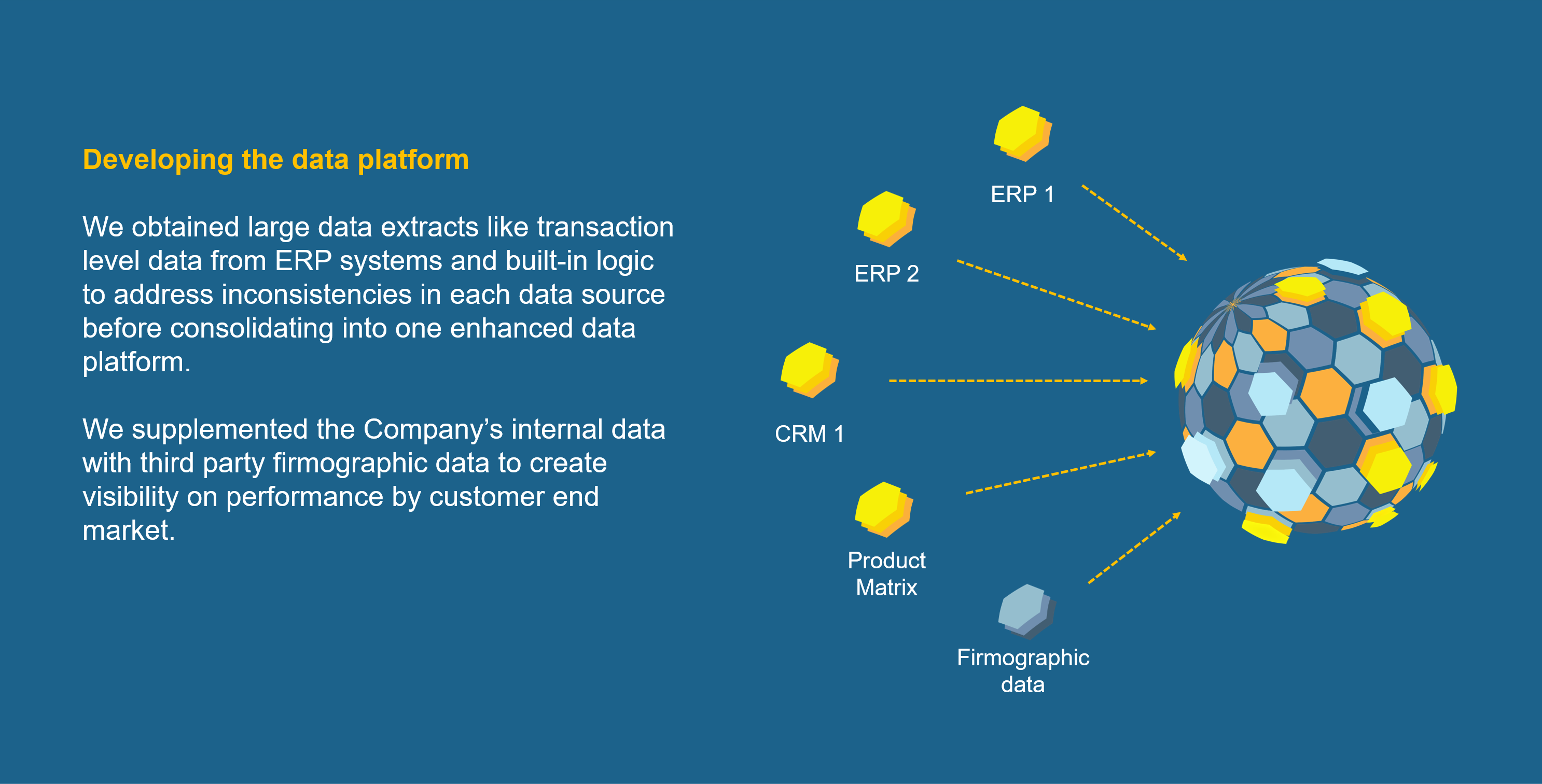

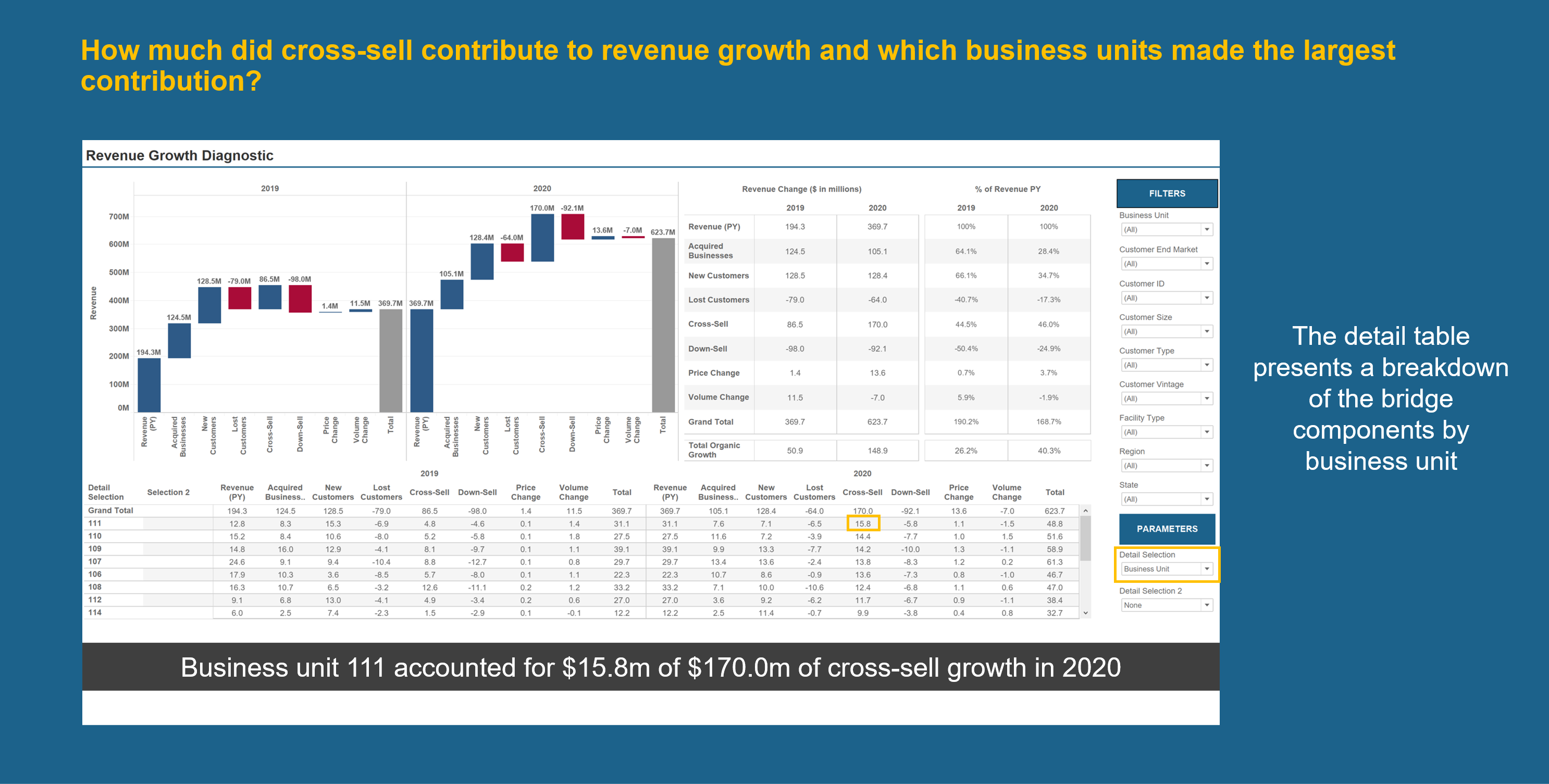

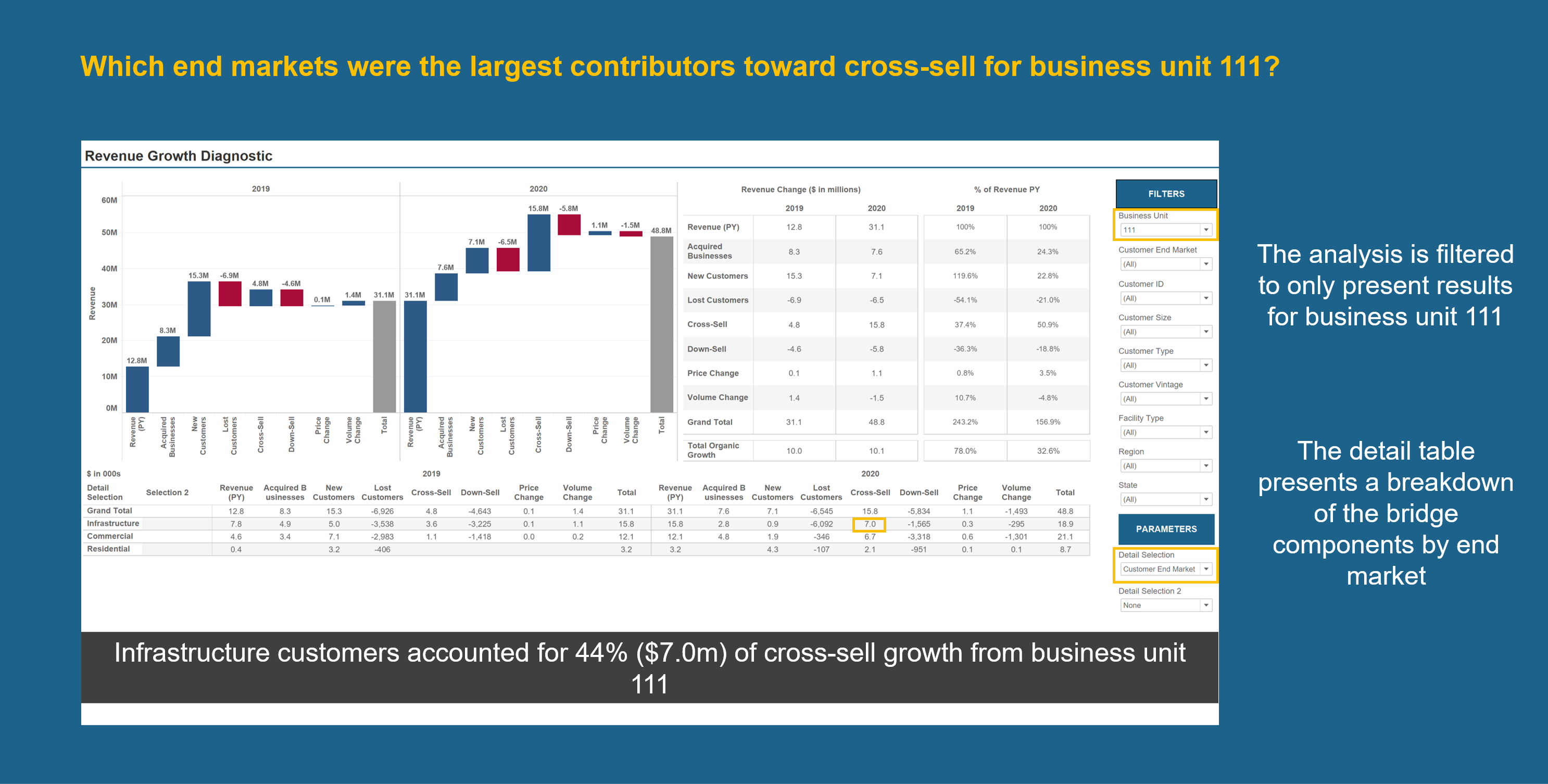

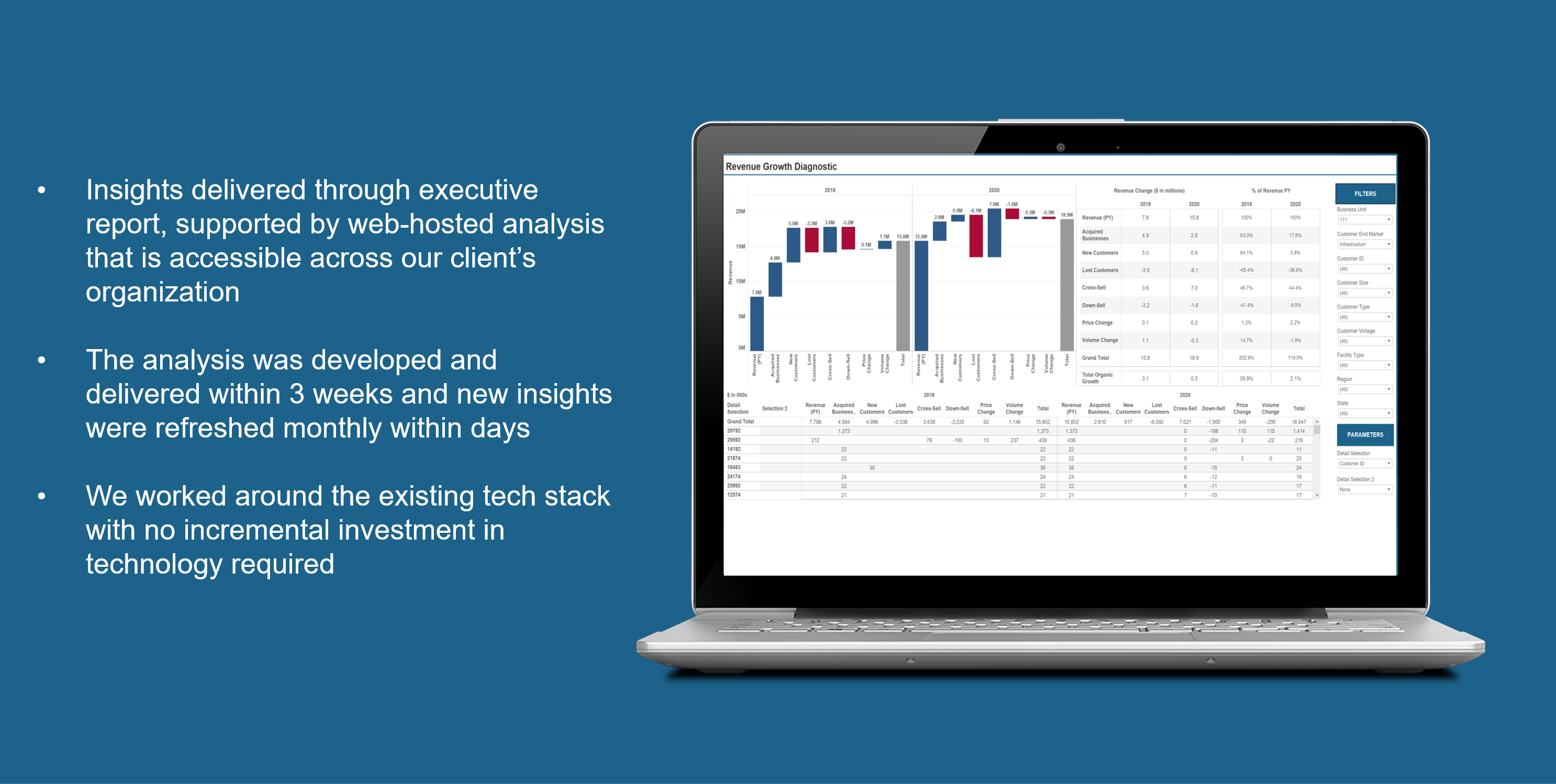

Within weeks Propel32 had developed an analysis that measured historical cross-sell trends by business unit, which informed growth assumptions during diligence. Post deal, this analysis enabled Finance to establish budgets that included cross-sell targets by business unit and sales teams to systematically identify cross-sell targets in achieving those growth targets.

The Opportunity

A recent acquisition delivered new cross-sell opportunities through new service offerings.

The Challenge

Inconsistencies between various data sources limited Management’s insight into historical cross-sell trends, ability to set budget targets for cross-sell, and opportunities for sales teams to focus on.

The Impact

Cross-sell targets representing 8% of revenue growth for the following year.

Our Approach

Site Level Performance Optimization

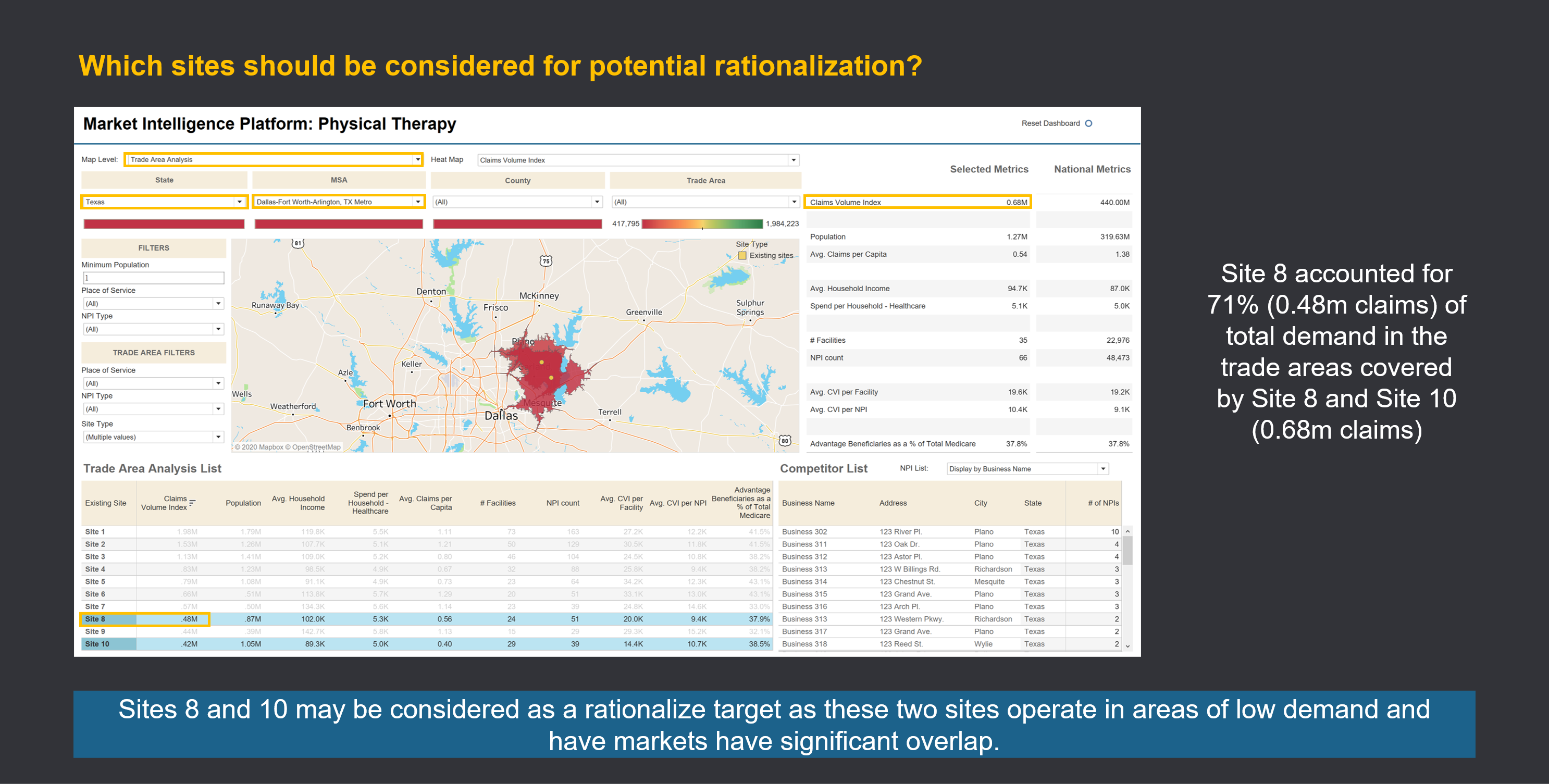

Sector: Healthcare

Type of Work: Value Capture

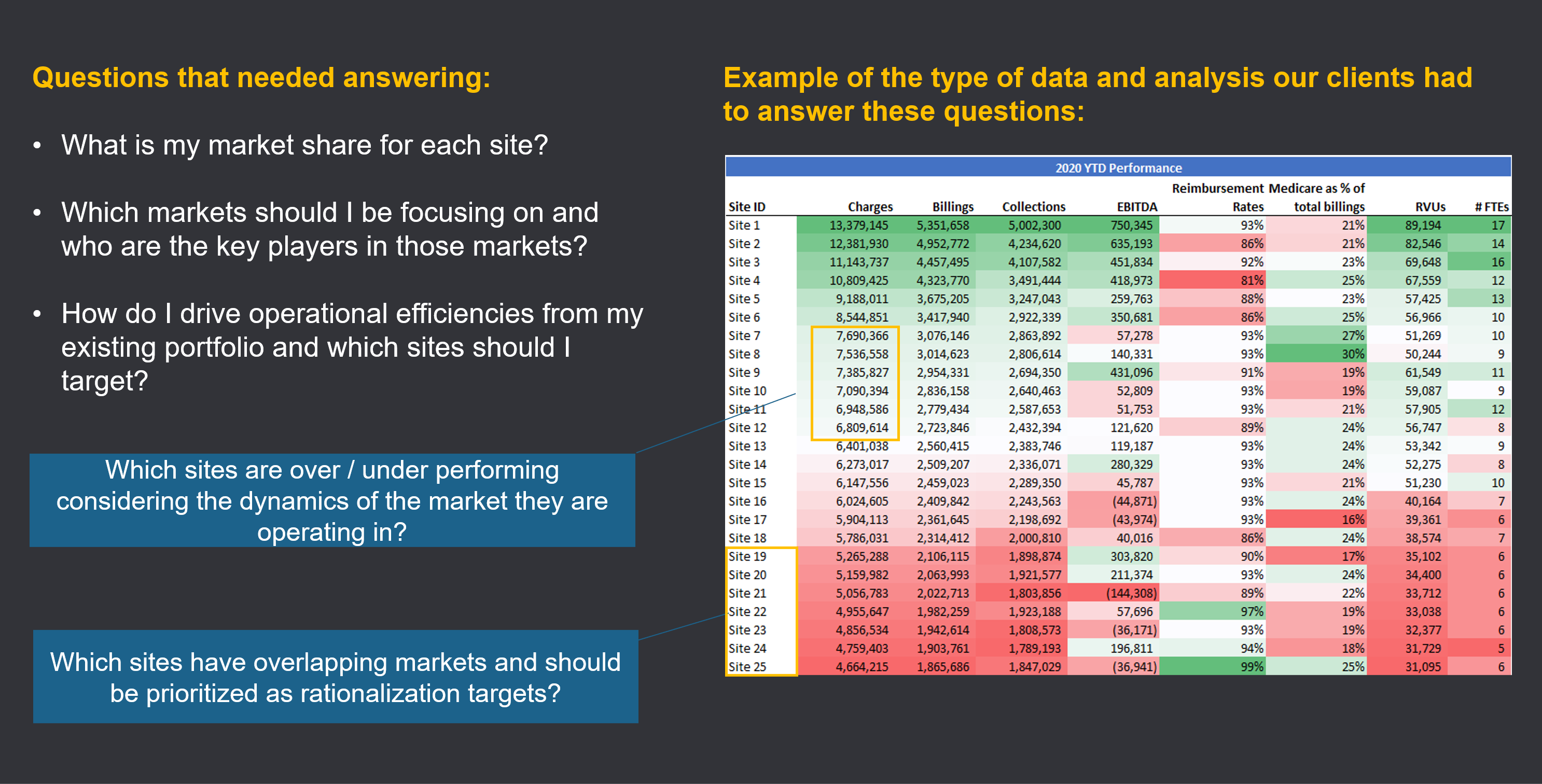

A healthcare provider with over 75 facilities across 8 states had experienced a change in demand driven by CV-19 and was considering options to right-size the business.

Our client lacked visibility into market share and the competitive landscape by facility, which limited the ability to make fully informed decisions around potential rationalization targets.

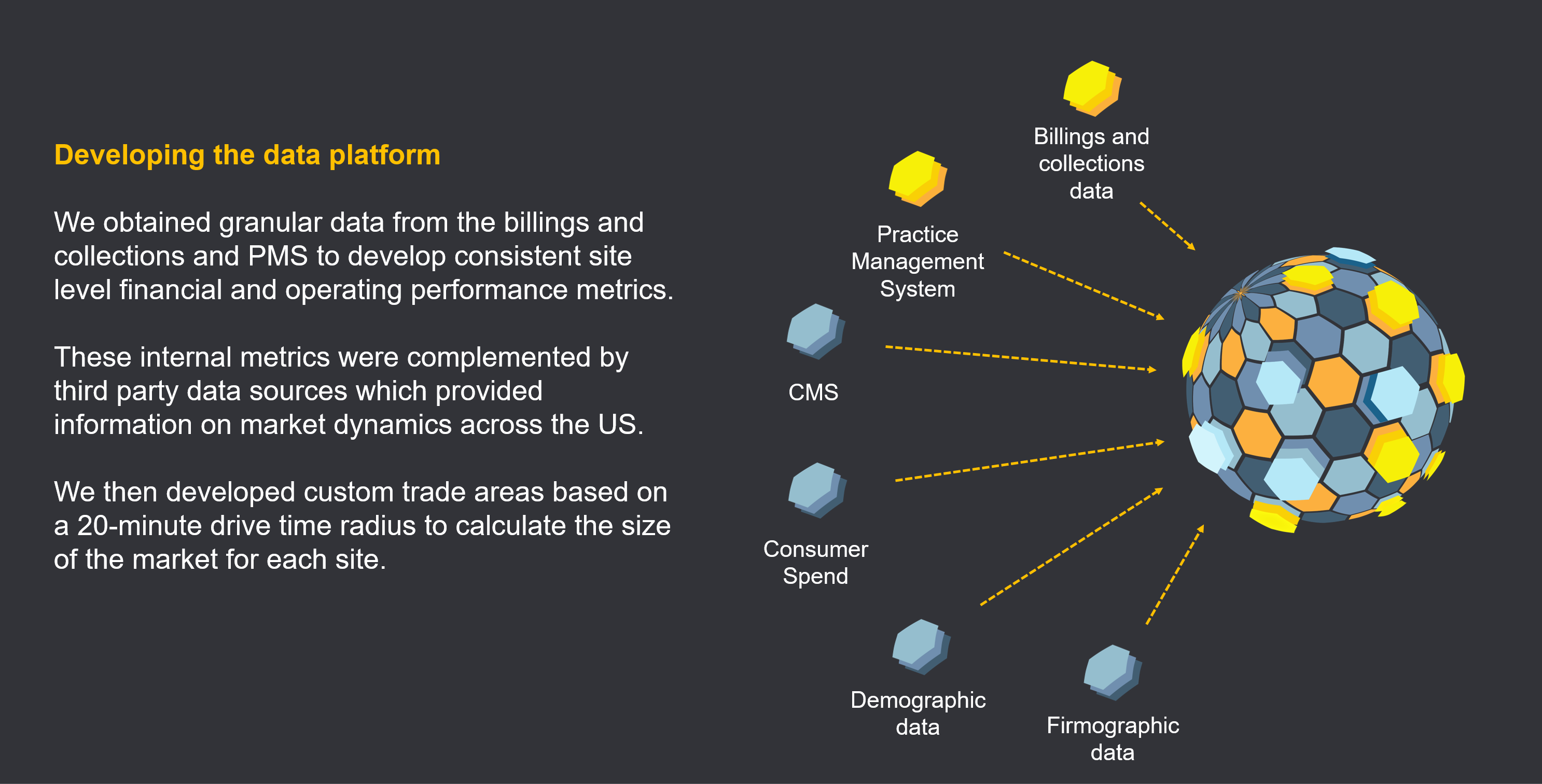

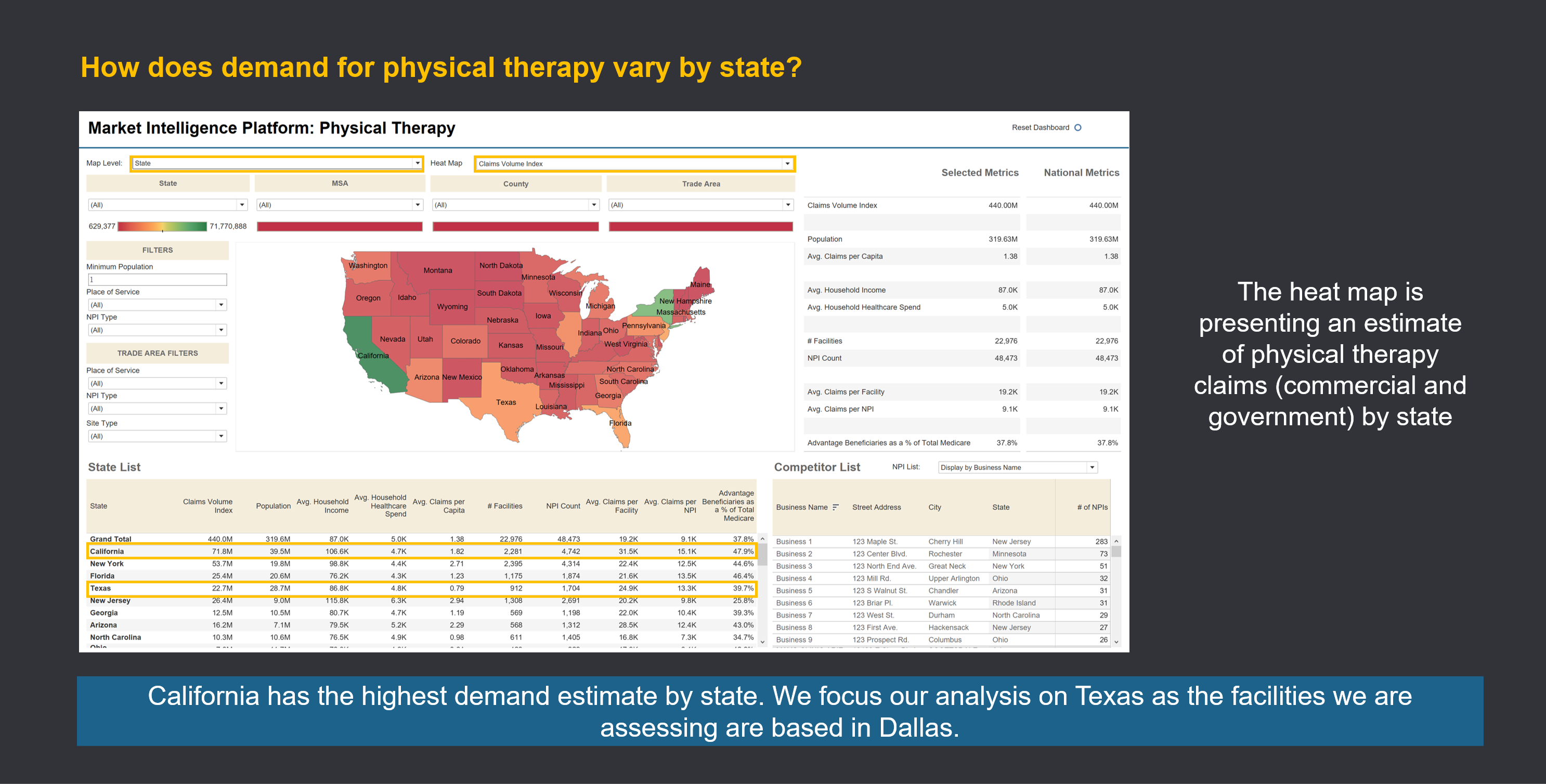

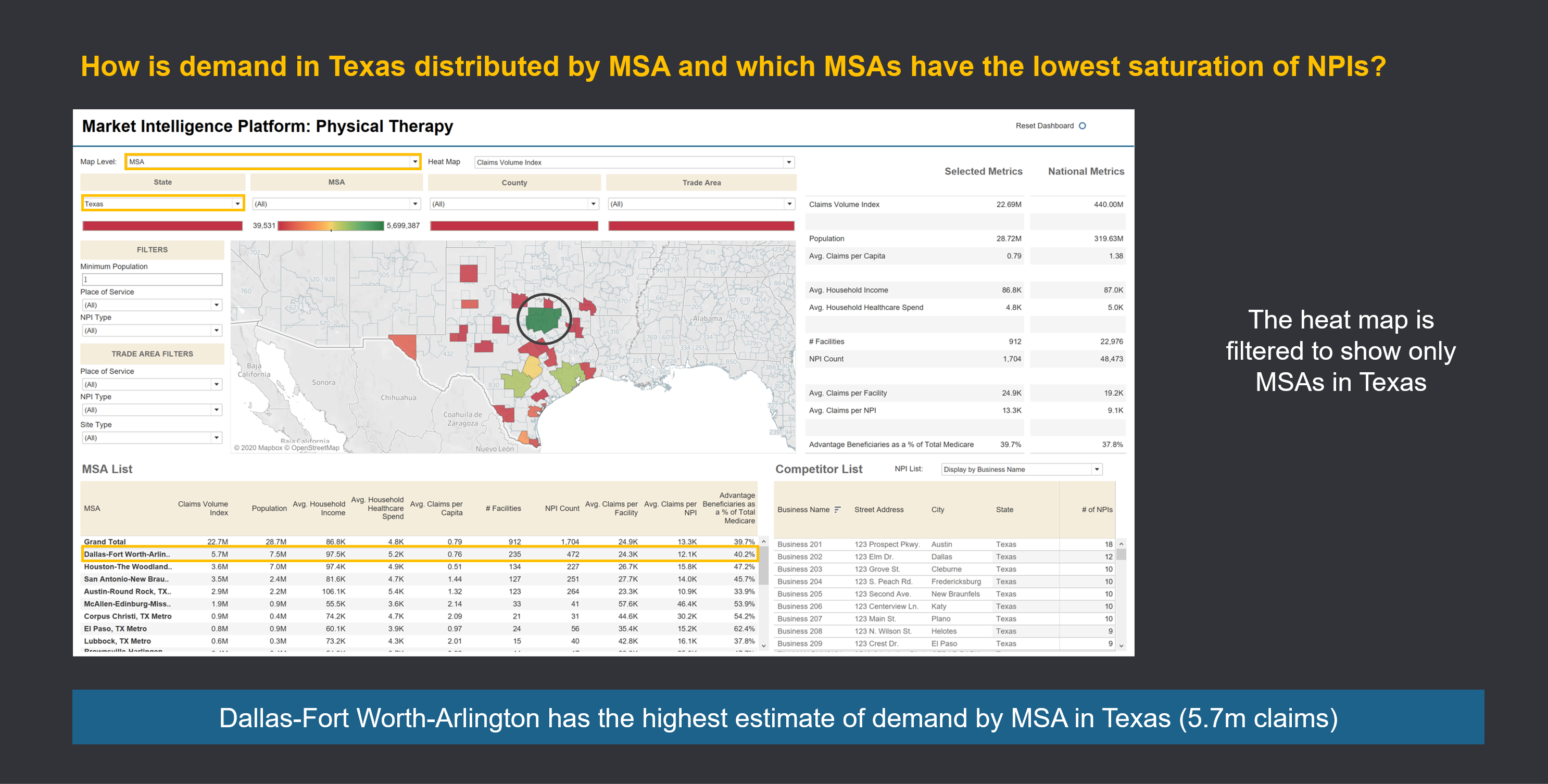

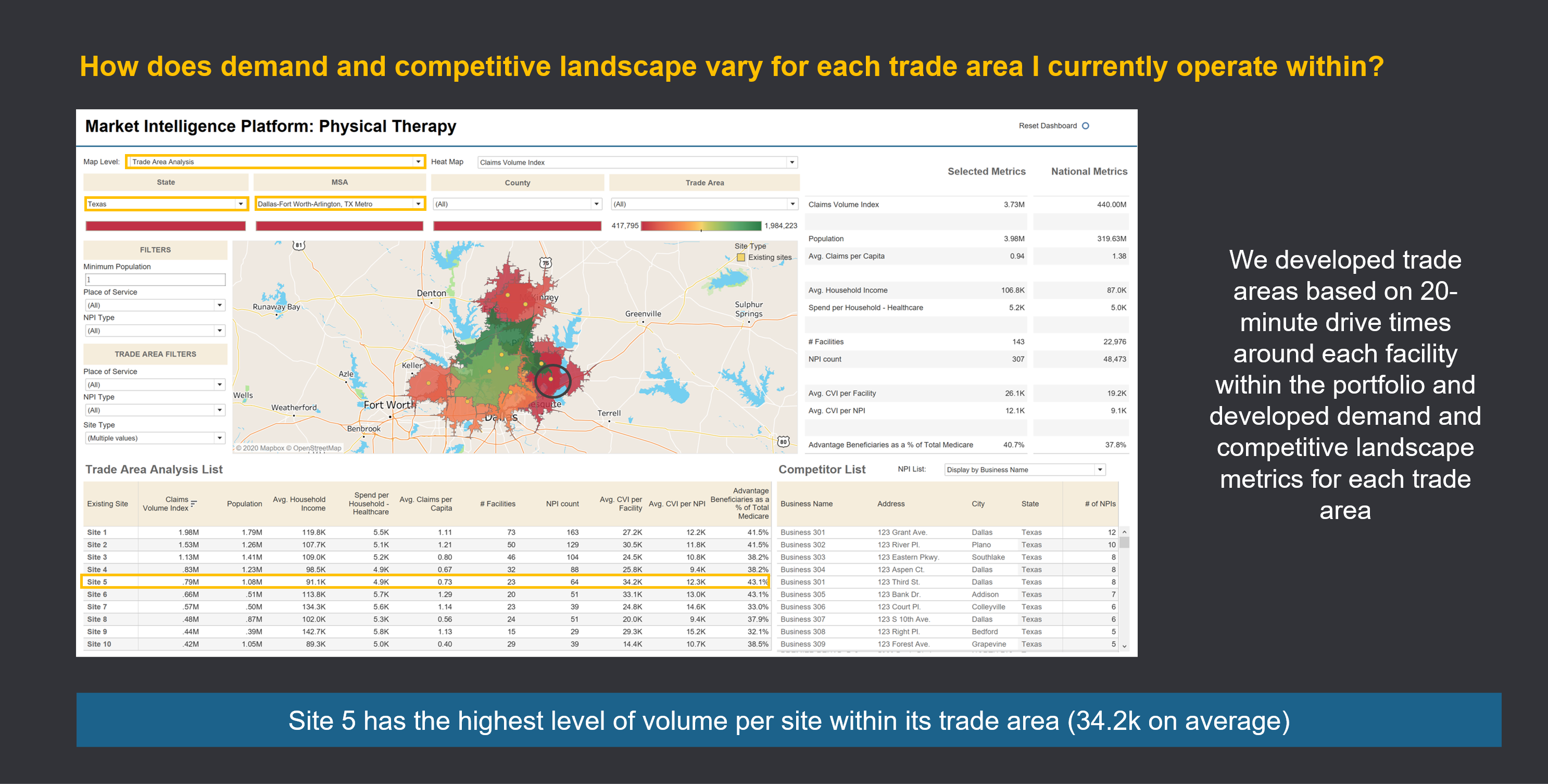

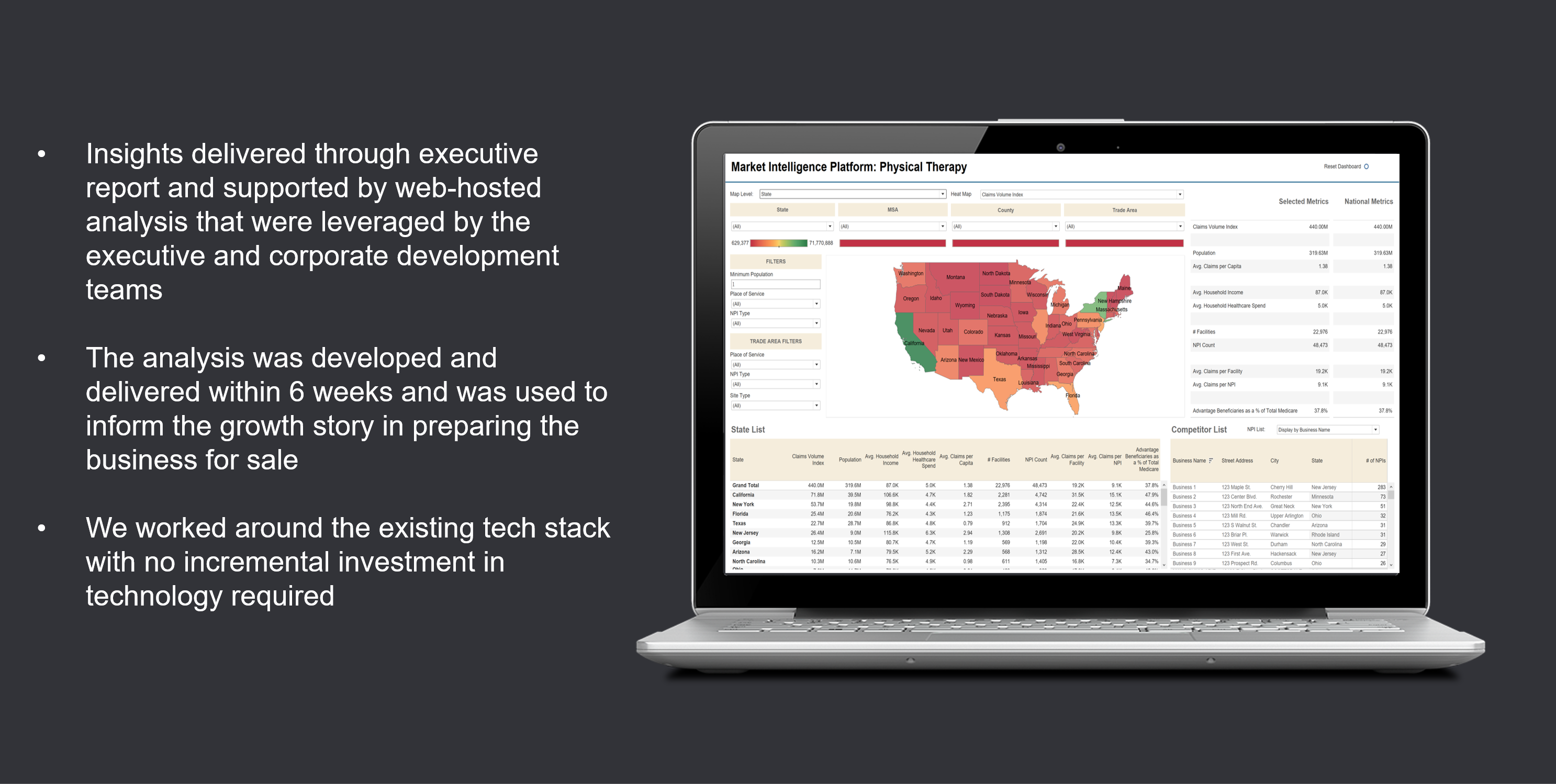

We leveraged a range of internal and third party data sets to develop a tailored market assessment platform that provided insight around market share, payor mix and the competitive landscape for each facility.

This analysis informed rationalization targets and helped benchmark site level performance to identify additional operational efficiencies for the remaining facilities.

The Opportunity

Re-adjust the cost base by to align to changing levels of demand due to COVID-19 by rationalizing underperforming facilities and re-allocating volume to increase utilization of the remaining portfolio of facilities.

The Challenge

Internal and third party data sets were large, complex and inconsistent with each other, making it difficult for management to attain the insights needed in the timeframe they were needed (within 6 weeks)

The Impact

Rationalization of loss making facilities in non-strategic markets and a 6% increase in the utilization of the remaining facilities.